Analysis: Impact of new transatlantic JV between Delta – Air France KLM – Virgin Atlantic

Introduction

On 2nd of August, the US Department of Transportation (DOT) gave tentative approval for a new joint venture between 4 airlines and it seems that Alitalia was not included in the equation!

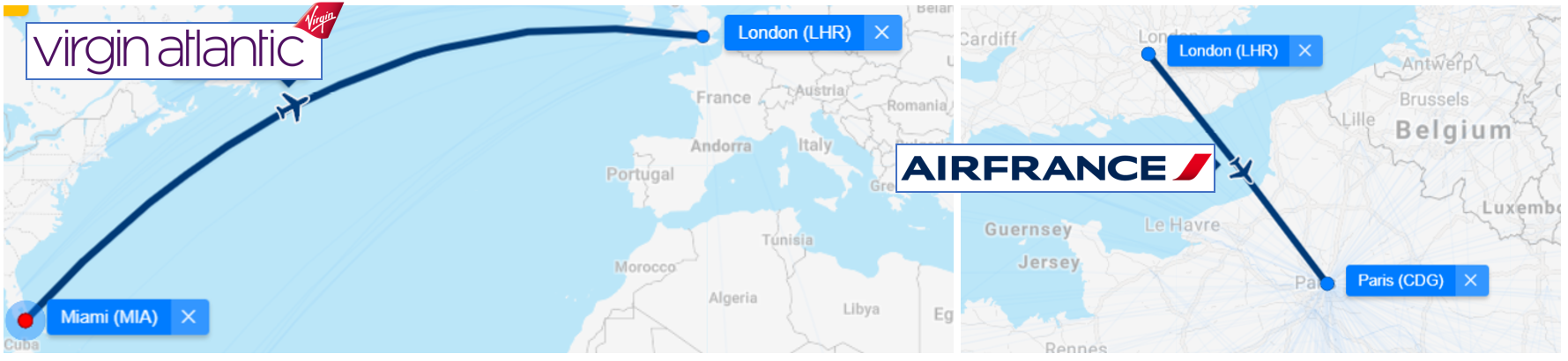

The airlines involved in the amended joint venture are Delta, Air France, KLM, and Virgin Atlantic.

This follows approval by the European Commission's Anti-trust regulator in February 2019. A statutory 2-week standstill period will allow other airlines to object on the grounds of unfair competition, however our understanding is that this joint venture will be approved given the similarities between the aggregation of standalone agreements that each airline has with each other.

Delta already had a 49% stake in Virgin Atlantic and 9% stake in Air France – KLM, meaning two separate JV’s already existed. Air France has 31% stake in Virgin Atlantic thus leaving 20% to the Virgin Group, which will retain chairmanship of the airline.

The main aim of this joint venture is therefore to ‘close the triangle' and improve the transatlantic network whilst competing with the Star Alliance and OneWorld counterparts.

The other reason is to compete with low-cost airlines such as Norwegian, which increasingly flies both short and long-haul routes although the extent of the competition is seemingly unclear due to the different business models they have.

However, Alitalia will not form part of the amended joint venture. This is, in my opinion, a big set back for the already loss-making airline that is heavily subsidised by the Italian government. In fact, their north-American business was one of its remaining successes.

Joint Venture – What are the benefits (and drawbacks)?

A Joint Venture allows multiple airlines to coordinate their pricing, flight schedules and ultimately share revenue.

Ticket prices may go up, due to the fewer number of legal entities competing against each other, however healthy competition between each joint venture is still obviously welcome. The regulators have obviously felt there would be enough competition to ensure stability in the transatlantic flight market.

However, it’s not all doom and gloom. Frequent flyers will soon be able to redeem Flying Blue miles with Virgin Atlantic and vice versa. This is a major benefit for those who finally want to use their Flying Club miles on short-haul European flights or to redeem in transatlantic first class on approximately 10 daily flights with Air France’s La Première cabin..

Should you have flexibility in travel and are able to take longer to travel to your destination, one big benefit is the ability to add transfer points to your itinerary and book into cheaper fare buckets and lower your overall fare.

Who flies what?

Though not specific to this amended joint venture, at airports with several terminals such as London Heathrow (LHR), this could confuse some travellers if they do not understand codeshare agreements, or if airlines don’t communicate differences between marketed and operated carrier effectively. (Even sometimes we get caught out, and we're seasoned professionals!).

For example, take a customer who buys their tickets for London to New York from KLM for a flight operated by Virgin Atlantic. Virgin operates all their flights from Terminal 3 at Heathrow whereas KLM operates out of Terminal 4. It may seem obvious to the frequent flyer that KLM only flies to The Netherlands but consider a typical layperson who books through an online travel agency or has zero interest in aviation and may not realise the differences involved.

What about Star Alliance and OneWorld Joint Ventures?

Up until now, the biggest transatlantic joint venture was that between Delta/ Air France/ KLM/ Alitalia with over 270 daily intercontinental flights. We tried digging out information on estimation of passenger numbers between all three joint ventures and the best we could summarise is that Skyteam and Star Alliance transatlantic joint ventures will be roughly comparable in size (We estimate about 260-270 flights per day, extrapolating the figures) while the Oneworld (British Airways / American Airlines / Iberia / Finnair) will be a little over half the size at around 130 flights per day.

There may be a market shift now that the United Kingdom will be added as a primary hub of the new Skyteam joint venture and this may shift the balance away from OneWorld slightly.

Bottom line

The creation of this new transatlantic joint venture is a significant market move. The longer term impacts, and whether this really is good or bad for competition, are yet to be seen. SkyTeam frequent flyers will probably be the overall winners here as they will be able to freely choose which airline they fly on given Virgin’s new involvement. All this of course relies on each airline crediting miles to each others' similarly!

A third big consortium does seem like a significant step towards oligarchy though.

No chance getting a La Premiere redemption if you are not a FB elite member.

Oneworld has just over 50% share of the transatlantic market rather than “half the size”- bad wording.

Do I understand correctly that Alitalia will now be completely shut out? Is its joint venture with Delta and AF/KLM now dead?

From our understanding of the new JV, yes

Air France only allows their elite Flying Blue members to book an award ticket in La Première so probably not going to open space for Flying Club members

True under current rules. This may still change in the future so the possibility is still there. We’ll amend the post accordingly, thanks.

It’s all good natured around here!