Transferwise Borderless: The new online account for international finance

Transferwise are a growing force in the foreign exchange section. Their business model is essentially ‘offer everything for nearly nothing, and hope everyone gets on board'. As an individual consumer and business owner working in multiple currencies, this is a really helpful tool for me.

Today Transferwise have released a new kind of account – the Borderless. It looks pretty exciting especially for digital nomads like myself. Essentially you can use now Transferwise as a holding entity in multiple currencies. Exchanging between currencies is performed at the spot exchange rate plus their usual commission of 0.5% with a minimum of 2GBP/EUR/USD (described below and also on their official page here).

On the face of it, it looks pretty enticing. No monthly or annual fees, no adding or receiving fees and they even provide you with an individual bank account number so this interfaces well with the ‘traditional' bank transfers. This bank account number service currently only applies for USD, EUR and GBP accounts, but they plan to expand to multiple other currencies within this year.

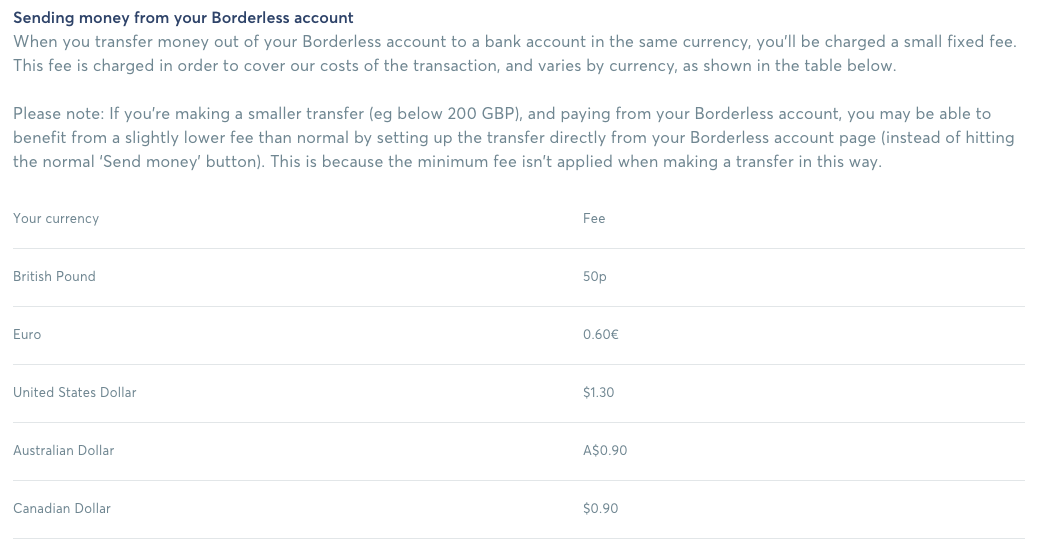

The two fees they do charge are for exchanging currencies, mentioned earlier, and withdrawing money from your Transferwise Borderless account to your normal bank account, a snapshot of which I have put below, but you can also click on the image to take you to the official page, or click here.

(For British Pounds and Euros, the fee is very reasonable at £0.50 or €0.60 due to European Union regulations.)

I managed to sign up for the Borderless account within about 5 minutes. I already had a Transferwise account so it was just a case of clicking a few extra buttons and doing an SMS verification that it was me who requested it. Once your first currency is set up, the rest can be done within 10 seconds per new currency.

This looks set to topple my Paypal account, which charges me much higher rates and AWFUL exchange rates thus avoided for a while. I encourage you to sign up to Transferwise Borderless instead!

why not use Revolut?

There will be a comparison article between the services in the near future!

Indeed why not. Revolut usually gives better rates and the app is extremely user friendly. I use my UK issued Santander card for fee free and good FC rate ATM withdrawals overseas and my US issued credit card for foreign purchases as that has no FC charge, gives a great rate and airline miles. To benefit all round you need a suite of accounts and cards.